Soon, Apple Card customers could be capable to open a “new high-yield Savings account,” Apple says. There’s simply one hitch: Apple won’t say what hobby charge it’s offering.

There’s additionally no particular timeline for whilst clients can get entry to those financial savings bills.

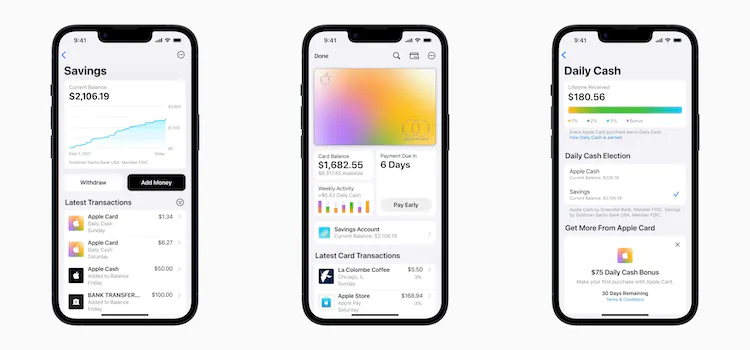

Apple has been getting into fintech with the Apple Card, which its companions with Goldman Sachs on. As one of all its perks, card customers get Daily Cash, Apple’s unique branding at the extra mundane cashback rewards, on their purchases. The promise of this “high-yield” financial savings account is that cardholders could have their Daily Cash deposited into it “and not using a fee, no minimal deposits, and no minimal stability requirements,” the organization says.

This isn’t the primary financial savings account presented with the aid of using a tech organization — PayPal currently delivered a financial savings account with a 2.forty-five percentage annual percent yield (APY), and Robinhood has examined comparable features. Apple, which additionally gives purchase now, pay later services, seems to have determined that competing with tech groups isn’t enough. It additionally desires to compete with banks. Of course, banks normally inform you what the hobby quotes on their financial savings bills are.

.webp)

Anyone who has the account also can deposit finances into the brand new financial savings account from a connected financial institution account or from their present Apple Cash stability. Once it’s set up, all Daily Cash acquired will robotically be deposited into it, even though customers can alternate that to position it at once at the Apple Cash card with inside the Wallet app.

The cashback rebates at the Apple Card are 1 percentage for maximum purchases, 2 percentage whilst the usage of Apple Pay, and three percentage whilst shopping for from Apple or a number of its companions, like Uber, Nike, or T-Mobile.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22808411/ELDENRING_21.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/16187167/acastro_190412_1777_slack_0002.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24047545/a30_pdp_full_bleed_3_desktop.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24106181/apple_card_daily_cash_savings_accout.jpg)

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·